South Africa ESG Mining Disclosure Ranking for 2019 – Gold Miners Lead the Way

…Risk Insights and Instinctif Partners release 2019’s SA Mining Sector ESG Disclosures Ranking...

ESG (Environmental, Social and Governance) risk management company, Risk Insights, and ESG business communications firm, Instinctif Partners, today released the South African Mining Sector ESG disclosure rankings for 2019. Findings for this report are derived from Risk Insights’ proprietary ESG GPS rating tool that uses AI and machine learning algorithms to transform publicly available disclosure reporting, integrated reports, etc and media coverage into ratings for environmental, social, and governance metrics. The research is based on disclosure and not the actual rating of the company. ESG GPS ratings use disclosure as part of its methodology to rate companies.

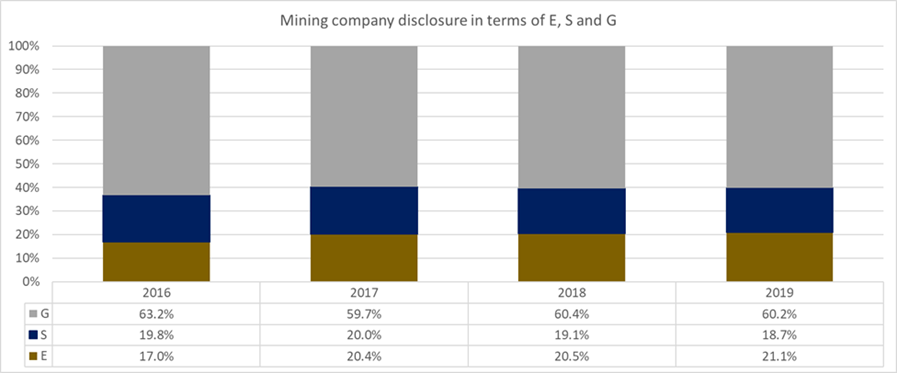

“A rising focus in stakeholder capitalism has exacerbated the need for mining companies to assess ESG risks and opportunities as a critical disclosure component. Many mining companies in South Africa have implemented voluntary ESG reporting standards over the last few years. Our research shows that governance disclosure still makes up more than 60% of total disclosure on average for the mining sector cohort in 2019. Social factors, including community involvement in mining companies, is 18.7% and environmental disclosure is 21.1%.” ~ Anashrin Pillay, CEO of Risk Insights

The rankings are based on TF-IDF* scores that are completely independent and can be used by investors, corporates and other stakeholders to identify key ESG risks and opportunities for listed JSE players. The Risk Insights ESG database includes data for all listed companies on the JSE from 2016 – 2020, rated by sector for a particular financial year.

The JSE Mining Sector constitutes approximately 10% of the total market capitalisation of all JSE listed companies, contributing 9% to South African GDP and 2.6% to employment. The research was conducted across the 36 JSE mining sector shares with the best 10 mining corporates ranked according to total ESG (environmental, social, and governance) disclosure.

Environment

In a sector where environmental factors are top of mind, Harmony Gold, Gold Fields, and Sibanye Stillwater are the top ranked companies in terms of environmental disclosure. Responsible energy and water usage in light of climate change and resource optimisation are key disclosure areas.

“Mining companies are facing sharper scrutiny of the way they handle various environmental issues, including pollution, waste-water management, habitat protection and site remediation. This growing emphasis on ethics and sustainability is being driven by customers, investors, regulators and industry initiatives – as well as a genuine desire among some companies to operate in a sustainable way. Environment is also an area where the growing space of impact investing has an important role to play.” ~ Kim Polley, Managing Partner, Instinctif Partners.

SA Mining Sector Environmental Disclosures Rankings 2019

|

Company Name |

E TF-IDF score |

% |

Ranking |

|

Harmony Gold Mining Company Ltd. |

22,050 |

15% |

1 |

|

Gold Fields Ltd. |

17,568 |

12% |

2 |

|

Sibanye Stillwater |

17,209 |

12% |

3 |

|

Kumba Iron Ore Ltd. |

15,605 |

11% |

4 |

|

Glencore PLC |

14,680 |

10% |

5 |

|

Anglo American Platinum Ltd. |

14,269 |

10% |

6 |

|

Exxaro Resources Ltd. |

13,191 |

9% |

7 |

|

Impala Platinum Holdings Ltd. |

11,350 |

8% |

8 |

|

African Rainbow Minerals Ltd. |

10,521 |

7% |

9 |

|

AngloGold Ashanti Ltd. |

9,668 |

7% |

10 |

|

Total |

146,115 |

100% |

|

This year, the World Economic Forum's Alliance of CEO Climate Leaders meeting in January 2021 focused its discussions on the decarbonisation of supply chains globally. This group postulates that there are eight supply chains that cumulatively are responsible for more than 50% of global carbon emissions and that acting to mitigate climate change specifically in these areas will have an enormous positive outcome in the war on climate change.

Anashrin Pillay believes that focused endeavours around mining supply chains could also help to move the needle significantly.

"The decarbonization of supply-chains has the potential to be a total “game-changer” for mitigation of private sector climate impacts. Addressing supply-chain emissions is a multiplier strategy that could see companies impacting a volume of emissions much higher than if they were to focus purely on decarbonizing their own direct operations alone." ~ Anashrin Pillay, CEO, Risk Insights

Social

The gold miners again come out as the top-ranked companies in terms of social disclosure, where measures like employee health and wellness are considered. A big focus is the upliftment of communities in which the miners operate and the securing of social license to operate.

“License to operate has evolved beyond the narrow focus of societal and environmental issues. There are now increasing expectations of shared value outcomes from mining projects. Any misstep can impact the ability to access capital or even result in a complete loss of license – particularly in light of the increased use of social media, which makes potentially negative publicity more globally visible than ever.” ~ Kim Polley, Managing Partner, Instinctif Partners.

SA Mining Sector Social Disclosures Rankings 2019

|

Company Name |

S TF-IDF score |

% |

Ranking |

|

Harmony Gold Mining Company Ltd. |

21,453 |

17% |

1 |

|

Sibanye Stillwater |

17,340 |

14% |

2 |

|

Gold Fields Ltd. |

14,437 |

11% |

3 |

|

AngloGold Ashanti Ltd. |

13,326 |

11% |

4 |

|

Kumba Iron Ore Ltd. |

12,471 |

10% |

5 |

|

Anglo American PLC |

10,829 |

9% |

6 |

|

Impala Platinum Holdings Ltd. |

9,609 |

8% |

7 |

|

African Rainbow Minerals Ltd. |

9,497 |

7% |

8 |

|

Anglo American Platinum Ltd. |

9,091 |

7% |

9 |

|

BHP Group PLC |

8,778 |

7% |

10 |

|

Total |

126,830 |

100% |

|

Governance

Regulatory compliance, whether complying to the mining charter or carbon tax legislation remains the core disclosure for mining companies.

“Governance disclosures, especially about health and safety protocols dominate all mining companies ESG risk registers. What is interesting is that the South African mining sector appears balanced when comparing governance, social and environmental disclosure,” says Pillay.

SA Mining Sector Governance Disclosures Rankings 2019

|

Company Name |

G TF-IDF score |

% |

Ranking |

|

Harmony Gold Mining Company Ltd. |

59,159 |

15% |

1 |

|

Gold Fields Ltd. |

58,578 |

15% |

2 |

|

Sibanye Stillwater |

43,917 |

11% |

3 |

|

Kumba Iron Ore Ltd. |

39,905 |

10% |

4 |

|

AngloGold Ashanti Ltd. |

37,346 |

9% |

5 |

|

Glencore PLC |

37,419 |

9% |

6 |

|

African Rainbow Minerals Ltd. |

32,426 |

8% |

7 |

|

Anglo American PLC |

32,751 |

8% |

8 |

|

BHP Group PLC |

30,629 |

8% |

9 |

|

Exxaro Resources Ltd. |

26,784 |

7% |

10 |

|

Total |

398,912 |

100% |

|

Overall ESG Ranking

Harmony Gold, Gold Fields and Sibanye Stillwater occupy the top three positions in terms of overall ESG disclosure. The research has shown that South African miners have broadly good disclosure.

Kim Polley adds, “It isn’t surprising that the gold miners rank so well; the industry has been robustly regulated for a number of years and has made many strong commitments towards ESG and sustainability goals globally. In fact, the World Gold Council published a report entitled “Gold Mining’s Contribution to the UN Sustainable Development Goals” in December 2020 that outlined how leading gold mining companies are making a significant contribution towards the UN’s Sustainable Development Goals (SDGs). However, what’s key is that there is a clear opportunity for other commodities miners to step up their own ESG agendas too. ”

SA Mining Sector Overall ESG Disclosures Rankings 2019

|

Company Name |

ESG TF-IDF score |

% |

Ranking |

|

Harmony Gold Mining Company Ltd. |

102,661 |

15% |

1 |

|

Gold Fields Ltd. |

90,583 |

14% |

2 |

|

Sibanye Stillwater |

78,466 |

12% |

3 |

|

Kumba Iron Ore Ltd. |

67,981 |

10% |

4 |

|

Glencore PLC |

60,457 |

9% |

5 |

|

AngloGold Ashanti Ltd. |

60,413 |

9% |

6 |

|

Anglo American PLC |

52,911 |

8% |

7 |

|

African Rainbow Minerals Ltd. |

52,769 |

8% |

8 |

|

BHP Group PLC |

48,947 |

7% |

9 |

|

Exxaro Resources Ltd. |

47,888 |

7% |

10 |

|

Total |

663,077 |

100% |

|

Anashrin Pillay of Risk Insights comments, “A key commercial driver for mining companies to implement stronger ESG measures is the ability to attract capital and remain sustainable. And impact investors are increasingly integrating ESG into their investment process to help identify risks during due diligence, to capitalise on opportunities post-acquisition, and to facilitate information disclosure in exit.”

Larry Fink, BlackRock CEO’s annual letter is an important example of the global call to action on climate change. He has asked all companies “to disclose a plan for how their business models will be compatible with a net-zero economy”.

Four Risks Miners Should Focus on for ESG in 2021

According to the ESG GPS, there are four key risks the mining sector should focus on in 2021.

1. Governance: Non-alignment to ESG disclosure and integration

Disclosure and integration of ESG factors will assist with the mitigation of ESG risk and value creation for all stakeholders. Disclosure into reporting and strategy will allow for year-on-year measurement, as will the purposeful alignment with recognised, global sustainability frameworks. There are a number of regulatory and legislative requirements in the mining of different commodities, and the sector by in large adheres well to these. However, it is worth considering what can be done to go beyond the requirement to proactively implement enhanced governance well beyond the basics of current best practice.

2. Social: Diversity and Inclusivity

Transparency around gender, race, and inclusivity is important to attract talent and for brand and reputation. While the mining industry has made good strides in terms of diversity in its workforce over the past few years, there is still a requirement to look beyond the physical numbers of diverse employees, or the diversity of the demographics, to inclusion. Inclusion focuses on valuing, recognising, and leveraging diversity, this will help optimise their businesses. Another issue gaining prominence in South Africa is board diversity, both in terms of colour and gender.

3. Governance: Health and Safety

Achieving optimal health and safety levels has been especially taxing in the last 12 months as maintaining business continuity during Covid-19 has come at a high cost. Mines have faced added expenses relating to new procedures and protocols, the introduction of health testing equipment, and ensuring that the workforce is supported appropriately. At the same time, the pandemic has heightened stakeholder expectations around how miners prepare for, manage and monitor all high-impact risk exposures. That being said, in 2019 the South African mining sector recorded a 40% improvement in mining industry safety performance.

4. Environment: Climate change

Decarbonisation is becoming more of a focus, and some of the larger players have already outlined their plans to decarbonize operations. However, for many in the mining sector, especially for junior companies, slow or inadequate progress may threaten their ability to access capital in an increasingly tight market. Mining companies that power their operations with renewable energy, operate electric or hydrogen-powered truck fleets, and integrate recycling in their value chains will be best placed to sell low-carbon premium minerals. Therefore, it is important to also track strategies and implementation of renewable energy, or hydrogen energy - which has become an important source of green energy – rather than just the company disclosures.

Disclosure of top 10 mining cohort from 2016 - 2019

Kim Polley concludes,

“The time is ripe for miners to take increased responsibility for helping to overhaul the image of the industry by communicating the value they are adding to local communities and economies, and by working to ensure that key stakeholders are taken along on the journey. So, in essence, it’s the need to maintain strong performance achievements while delivering value to external stakeholders beyond just compliance that is an opportunity for the sector.”

*Sustainability frameworks (CDP, GRI etc), together with the laws of South Africa, were considered when curating the list of “B words1” which forms the basis of the ESG-GPS rating model. A TF-IDF score for E, S & G is calculated for each mining company which is then compared to that of the total for the sector and expressed as a percentage.

1 Term-Frequency Inverse-Document-Frequency. This represents the relevance of each B’word 2 as a numerical value.

2 A variable generated from the laws of the land and the policies that govern a particular sector. These are used to measure the relevance of the disclosure on ESG factors by searching for the term in the company reports

About the Risk Insights ESG GPS Rating Model

The Risk Insights ESG GPS rating model uses publicly available data to produce an ESG Rating for each company listed on the JSE. Sustainability frameworks (CDP, GRI, etc.) together with the laws of South Africa are considered when curating the list of B’words2 which forms the basis of the ESG-GPS rating model. Artificial intelligence and machine learning algorithms are applied to transform the data collected into a TF-IDF score which represents the level of company disclosure on Environmental, Social and Governance factors. For this publication, TF-IDF scores were used to rank the mining sector.

About Risk Insights

Risk Insights is an established risk management advisory and consultancy boutique that is part of the World Economic Forum (WEF) New Champions Community. In November 2020, the company was awarded Excellence in Agile Business Governance award by the World Economic Forum. The singular focus of Risk Insights is to serve its clients with distinction and to support organizational transformation in order to unlock sustainable value creation for an organization. Risk Insights was founded in 2009 with the primary goal to assist in the improvement of risk management practices in South Africa and on the African continent for Development of Financial Institutions, Municipalities, State-Owned-Entities, Corporates, and Financial Institutions. Risk Insights team assists clients both in the private and public sector. Risk Insights is an accredited Level 1 BEE Company.

About Instinctif Partners

Instinctif Partners is an international business communications consultancy, partnering with its clients to build reputation, combat risk, and deliver value. Instinctif works with clients to engage multiple and complex audiences through deep insight, expert storytelling, and creative delivery. For 25 years the company has used its local and global knowledge to address specific market issues across public relations, investor relations, ESG communications, reputation management, and digital. Instinctif connects audiences, insights, and creative to drive impact through real and measurable commercial value. It is an accredited Level 1 BEE Company.